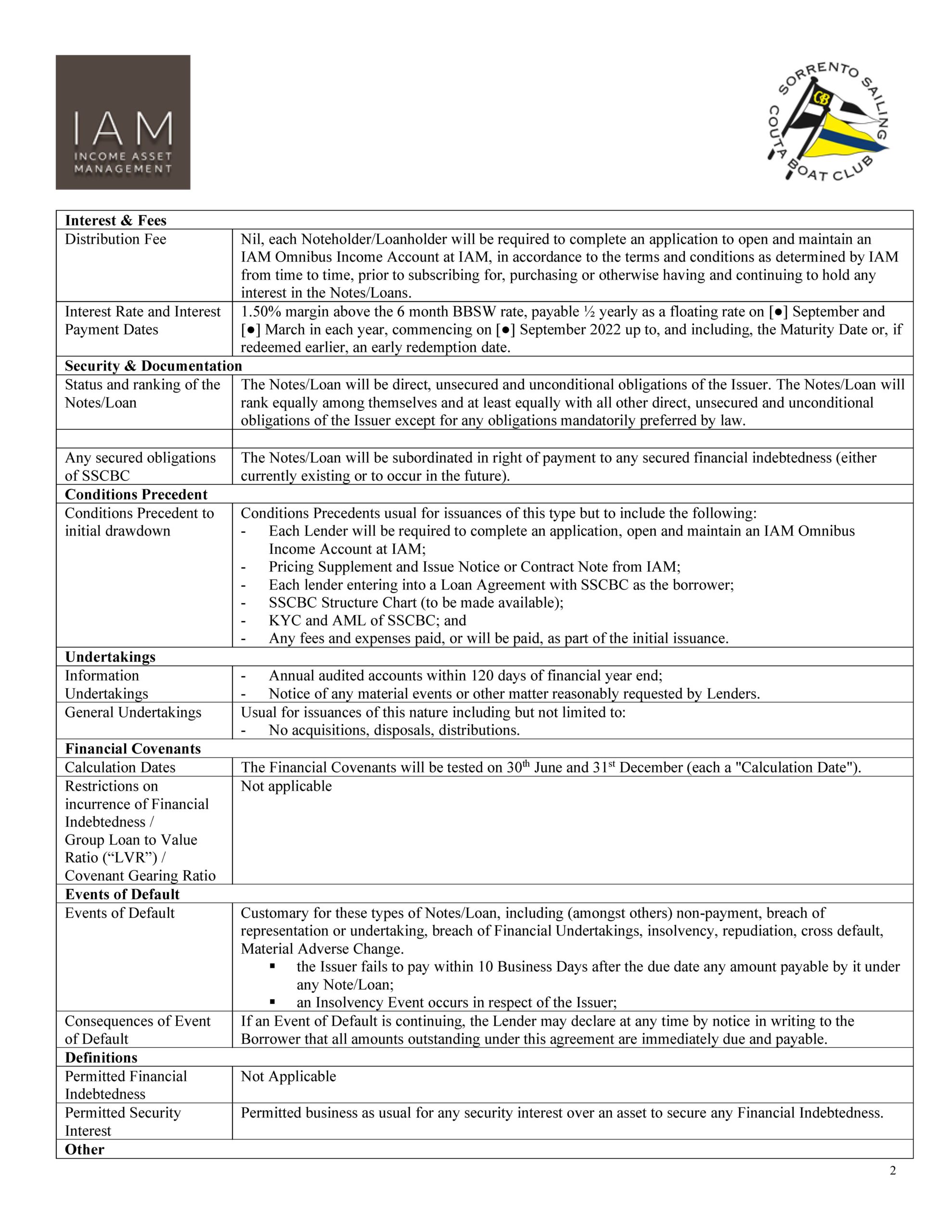

Member Bond Issue

The issuance of Member bonds to fund capital works has been highly successful for similar Clubs (Sandringham Yacht Club is a key example) and provides a flexible, low-cost mechanism to raise debt. The interest rate paid will be significantly higher than you would achieve with a financial institution, however lower than our NAB facility, effectively transferring the margin which would otherwise be paid to our bank to the benefit of the Club. The proposed structure contemplates periodic interest (coupons) and the repayment of face value plus any accrued interest after five years.

The Club has partnered with Income Asset Management (IAM) which has agreed to provide its platform and administrative services to SSCBC on no-fee basis (a director and major shareholder of IAM is a Club Member).

In short:

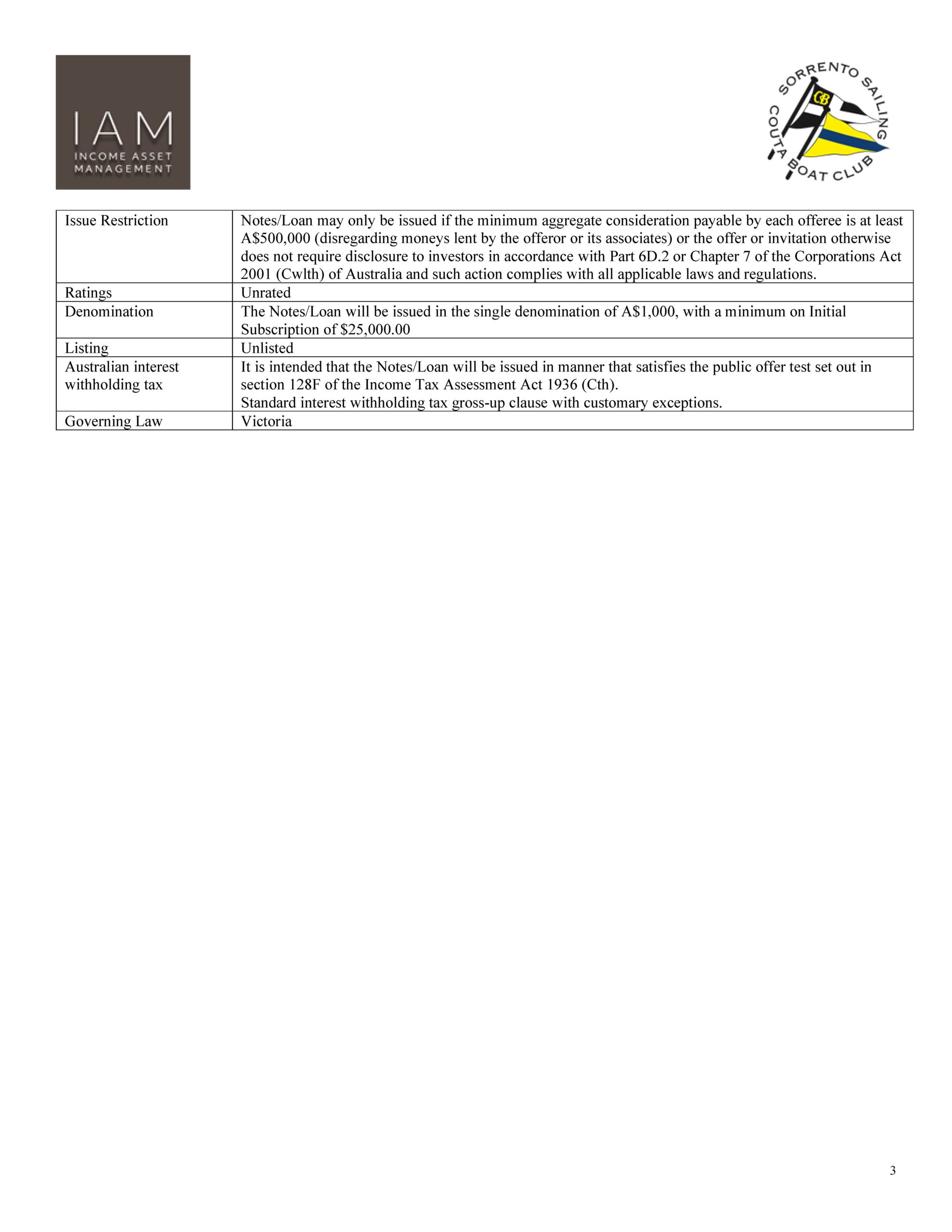

- Minimum of Initial Subscription of $25,000, with denomination of $1,000.

- Interest: 1.5% margin above the 6 month BBSW rate, payable ½ yearly as a floating rate.

- Maximum total issue amount $3,500,000

- Maturity date – 5 years after Issue Date

A term sheet detailing the terms of proposed bond offering is included below and further details are available for interested Members via scheduled information sessions or engagement directly with Club staff or me (contact details are below).

Email shaungchalmers@gmail.com or mobile 0425 833 338 or via the Club’s email: fundraising@sscbc.com.au.

Thank you for your interest in the Clubhouse redevelopment project and funding strategy.

Clubhouse redevelopment fundraising donor sheet – click here

Bond offering term sheet – click here or see below (click image to enlarge)